Your FREE Guide

1031 Exchange Guide – What Every Exchanger Needs to Know

Are you a real estate investor interested in building wealth and saving taxes or a businessperson looking to strategically sell commercial real estate?

Download our free guide to see if the 1031 tax deferral strategy to build wealth and save taxes will work for you!

1031 Exchange Resources & Tips

If you are considering the sale of real estate investment property such as apartment complexes, office buildings, shopping centers or land, a 1031 Tax Deferred Exchange is the IRS authorized method to defer paying the capital gains and depreciation recapture taxes associated with the sale.

Grab our complimentary guide to determine whether the 1031 tax deferral strategy can help you in building wealth and cutting down on taxes!

Reasons to Consider a 1031 Exchange

There are many advantages to structuring your real estate investment transaction

as a 1031 Exchange (also known as Tax Deferred Exchange, Like Kind Exchange,

Starker Exchange and Real Estate Exchange):

deferring taxes (up to 35 to 40% of the gain)

greater purchasing power

improved cash flow

portfolio diversification

portfolio consolidation

greater appreciation potential

freedom from joint ownership

estate planning for heirs

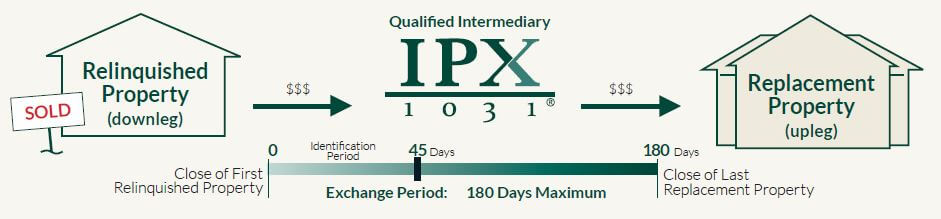

1031 Exchange Timeline

There are many rules and regulations that you must follow for a successful 1031 Exchange. To learn more about crucial 1031 timelines, Relinquished and Replacement Properties, equity and more, click here to get your free guide.

Ready to Get Started?

Whether you want to download your guide, ask us a few questions or are ready to start your 1031 Exchange, we’ve got you covered!

Get your FREE Guide on Everything to Know About 1031 Exchanges

Let's talk about your specific 1031 needs

Ready to start your 1031 Exchange?

Why Real Estate Investors Choose IPX1031 for their 1031 Exchange?

IPX1031 is a full service Qualified Intermediary and has offices and 1031 experts across the nation.

With a nationwide team of savvy attorneys, CPAs and Certified Exchange Specialists, IPX1031 services all of the United States by phone, video calls, email and in person.